In 2023, Japanese ice cream sales reached an unprecedented 608.2 billion yen, setting a domestic and international record. Taiwan, Hong Kong, and China have become the most prominent export destinations, with Taiwanese consumers showing a particular fondness for Japanese ice cream.

TOKYO, JAPAN (Business Northeast) – A strong recovery in Japan’s tourism industry, global warming, and the depreciation of the yen, among other factors, have driven Japanese ice cream sales to record highs. According to statistics from the Japan Ice Cream Association, sales in 2023 will reach 608.2 billion yen, an increase of 9.9% over the previous year and 39% over the past ten years. Japanese ice cream has hit a record high in terms of export volume, total export value, domestic sales, and even the average consumption of ice cream by a family. This means that ice cream lovers worldwide have favored Japanese ice cream. Taiwan, Hong Kong, and China import the most significant amount of Japanese ice cream, accounting for about 60% of total exports.

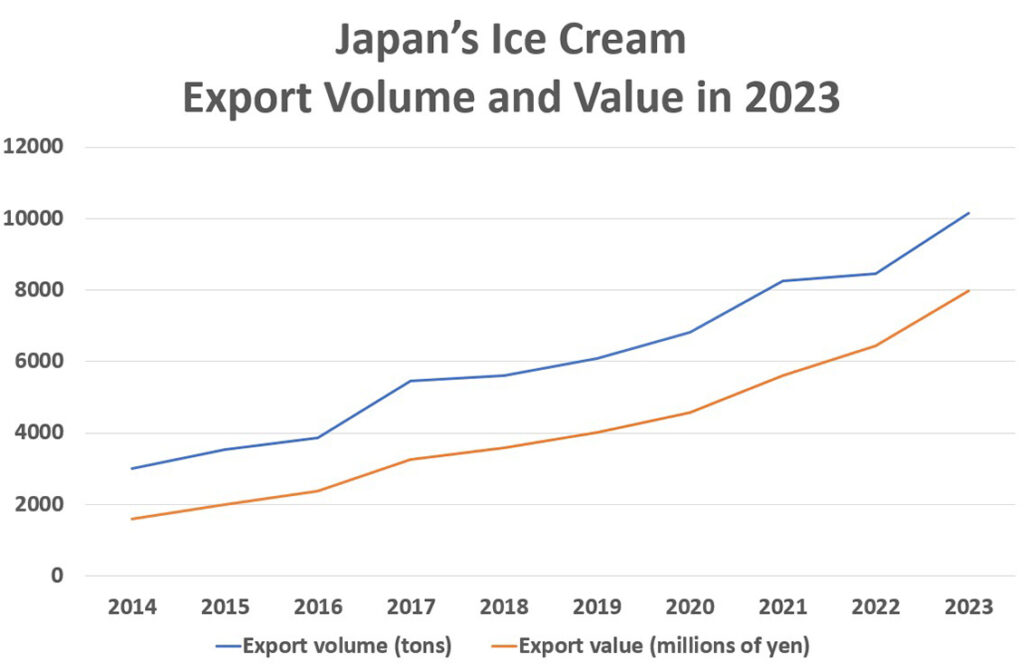

Despite the yen’s depreciation, Japan’s food exports increased by 102.9% from the previous year to 1,454.7 billion yen. In addition, global temperatures continued to soar, causing Japan’s ice cream export volume and export value to break new highs, exceeding 10,000 tons for the first time, reaching 10,138 tons, with export volume increasing by 119.8% year-on-year (year-on-year growth of 123.5% based on value). Among them, in terms of export destination ranking, Taiwan ranks first (3,104 tons), followed by Hong Kong (1,635 tons) and China (1,611 tons)—the top three account for more than 60% of total ice cream exports. Purchases from Taiwan and China increased about 1.5 times compared to last year, showing Taiwanese people’s love for Japanese ice cream.

According to the household budget survey (households with more than two people) from the Statistics Bureau of the Ministry of Internal Affairs and Communications, the amount of food expenditure exceeded 1 million yen for the first time, reaching 1,038,653 yen, a significant increase of 105.7% from the previous year. It can be seen that a wave of price increases has swept across All food. Ice cream expenditure accounted for 1.11% of food costs, exceeding 1% for the sixth year. The average household spending on ice cream in 2023 was 11,580 yen, a record high.

The rise in raw material prices is one of the reasons for the increase in ice cream sales. Due to the apparent rise in the prices of various foods, compared with other desserts and candies, the price adjustment of ice cream is relatively slow, which increases consumers’ willingness to buy. The people surveyed buy and eat commercially available ice cream at least once every two months on average, and 40% of the respondents said they eat more ice cream than last year, making ice cream the number one favorite dessert in Japan this year, with vanilla flavor The most popular flavor.

The Japan Ice Cream Association surveyed the types of ice cream that consumers often buy and found that “cup-shaped” is the most popular shape, followed by “bar-shaped” and “monaka-shaped”. Bar-shaped ice cream is more prevalent among women than men, while the monaka style is more prevalent among men than women. This insight into consumer preferences is crucial for companies to make informed decisions about their product development and marketing strategies.

Are you feeling dizzy with the continuous record-high temperatures? Find a convenience store nearby, open the ice cream cabinet, buy one of the most eye-catching Japanese ice cream products, and explore together how Japanese ice cream captures the hearts of consumers from all over the world.